FDIC or SIPC insurance…what’s it mean for me?

A Message to Our Clients,

You’ve likely seen headlines about the recent failures of Silicon Valley Bank and Signature Bank, commercial banks that were taken over by federal regulators on Friday and Sunday. While the government is taking steps to reassure investors, the bank collapses have understandably drawn nationwide concern along with other shakeups in the banking sector this week.

While the details surrounding the future of these firms and their assets are still unfolding, we want to address any apprehension you may have about whether these events affect the standing of your financial accounts and cash balances with Krozel Capital and explain the difference between FDIC & SIPC insurance.

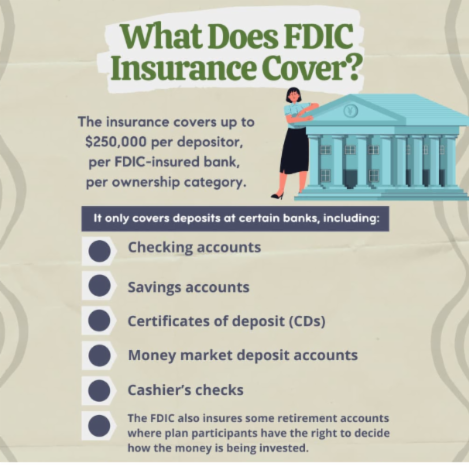

FDIC limits and why we care

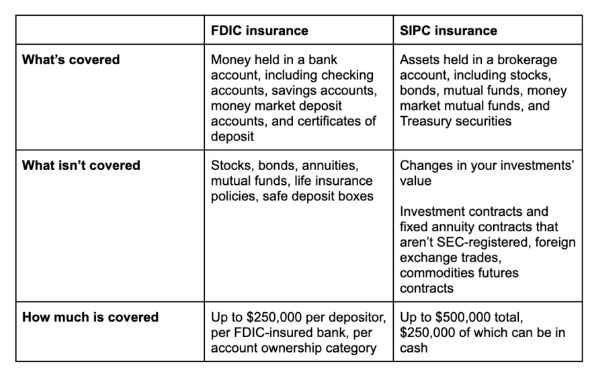

The FDIC mainly covers bank deposits. What is NOT covered? The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities or municipal securities, even if these investments are purchased at an insured bank.

Want to check if your bank is insured? Click Here to Search

If your investments are managed by Krozel Capital, they are not being held at a bank. While this means you are not covered by FDIC Insurance, you ARE covered by was is called SIPC Insurance.

Here is a good article explaining the differences between FDIC & SIPC and how they work.

If Krozel Capital ceases doing business, your funds are not affected since Krozel Capital does not have custody of your investments (FYI – Bernie Madoff’s firm HAD custody of the investments and DID NOT use a third party custodian…and we know how that ended).

Krozel Capital manages investments (ability to view, place trades and distribute cash to clients), but the investments themselves are held with a third party custodian.

Here is some additional info about the custodian Krozel Capital uses: https://www.ssginstitutional.com/why-ssg/

A full list of SIPC members can be found here.

It is important to note that SIPC is protection from brokerage/custody failure, but is not protection from downturns in the market. There is always risk with investing and fund balances can decrease with market downturns.

We hope these points offer you reassurance, but we recognize the short-term impact that bank failures can have on financial markets and consumer confidence. We’ll be closely monitoring the situation in the days ahead to evaluate any possible impact on your portfolio and financial plan.

In the meantime, we’re always available to answer your questions and offer perspective. Please do not hesitate to reach out. Thank you for your continued trust in us.